As we cross into the second week of the Russian invasion of Ukraine, investor willpower is being put to the test. On top of the war, investors are combatting inflation concerns and impending interest rate hikes that have initiated selloffs across multiple financial markets. To add insult to injury, Major League Baseball, historically an escape during times of crisis, has cancelled Opening Day for the first time in over 25 years. When will we catch a break?

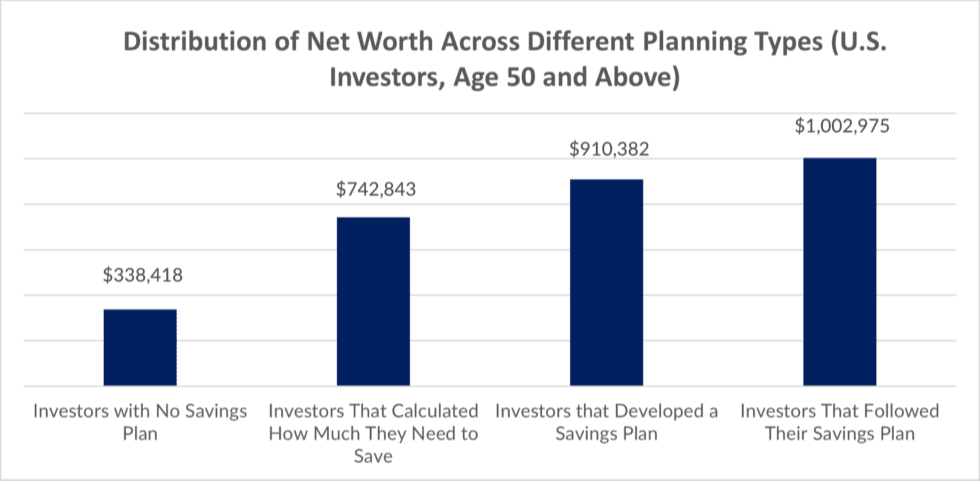

During times like this, financial planning can be an important tool to help investors focus on what matters during the most strenuous of times. To illustrate, the graph below comes from a study that shows the impact on net worth by implementing some element of a savings plan.

Source: Lusardi, A., & Mitchell, O. S. (2011). FINANCIAL LITERACY AND PLANNING: FINANCIAL LITERACY AND PLANNING:. Cambridge: National Bureau of Economic Research.

As you can see, the more planning elements incorporated (calculating, developing, following), the higher the net worth. Why is that? By incorporating purpose and structure, saving goes from an arbitrary concept to one with meaning and reinforcement.

Create a Purpose

The tumultuous events of 2022, especially the war, are all very real. They hit in the gut, displace our rationale, and potentially influence our decisions. As our minds extrapolate varying “what-if?” scenarios, more evidence is created internally based on assumed information, which can be a dangerous place for investors. With no purpose for savings, our emotions can overwhelm decisions that lack meaning. By establishing a purpose, this creates a tangible weight, tipping the scales back in the favor of reason and reducing the influence of turbulent events. If you refer to our blog Don’t Miss the Forest for the Trees, you can see how sticking to an investment plan puts ongoing disasters into perspective.

Build a Structure

Second, a structure creates clarity for your savings. When you understand what you are saving toward you can develop a gameplan for getting there. Once you have that gameplan in place, it becomes much easier to understand what needs to be done to achieve your objective. What can often be a daunting and confusing endeavor gets broken into bite-sized, digestible chunks that create good habits and increases the likelihood of sticking with the plan.

To get started on a savings plan, the following steps should be helpful:

- Identify What You Want to Save For: Whether it be a new house, the kid’s college or your retirement, establishing a tangible goal will bring meaning and success to your savings. You can then identify the cost, providing a basis for how you will save and how much it will cost.

- Evaluate Available Resources: Once you evaluate what you want, evaluate the tools and resources at your disposal to get there. How much do you currently have in savings? How much can you put away? When do you need it? What investment strategy is best for achieving your goal and letting you sleep at night?

- Work with a Financial Advisor to Keep You on Track: As investors, we are typically our own worst enemy and can easily get lost along the path to financial success. Working with a professional advisor can help you stay on track, especially during chaotic times like these.

By implementing the steps above, investors will have a clearer picture of what they want, a better perspective on events that influence the financial markets, and discipline to achieve financial success.

If you would like some help developing a successful savings plan, please give us a call.