Everybody knows –

1. Inflation is back.

2. The Fed is going to continue raising interest rates until inflation breaks.

3. Rising energy prices, food prices and interest rates are an economic depressant, but the Fed’s got this.

Here’s what everybody doesn’t know –

1. The Fed’s actual record of negotiating a soft economic landing following a rising rate cycle has been dismal. There have been nine rising rate cycles to combat rising inflation since 1961. Eight have ended with an economic recession (only 1994 was an outlier, a “soft landing”).

Here’s what you need to know –

When the Fed’s rising rate policy precipitates a recession –

1. Spending declines.

2. Inflation drops.

3. Interest rates fall.

So, which is it? –

1. We’re going to have rising inflation and interest rates for who knows how long.

Or,

2. The Fed policy once again gives us a recession, accompanied by falling inflation and falling interest rates.

Door number one or door number two?

If you pick door number one, it’s probably time to dump those bonds.

If you align with the lessons that history has taught us and pick door number two, sit tight. Rebalance as necessary. Keep the faith that the recurring cycles in the economy are still alive and well. And don’t try to be cute and outsmart the markets.

The timing of these events is impossible to forecast.

The process of forecasting interest rates (or the stock market, or any market for that matter) is notoriously inaccurate. For every forecast of increasing rates there is one of decreasing rates. Whenever forecasters reach a consensus regarding future interest rates, they are typically wrong, as rates have historically moved in the opposite direction.

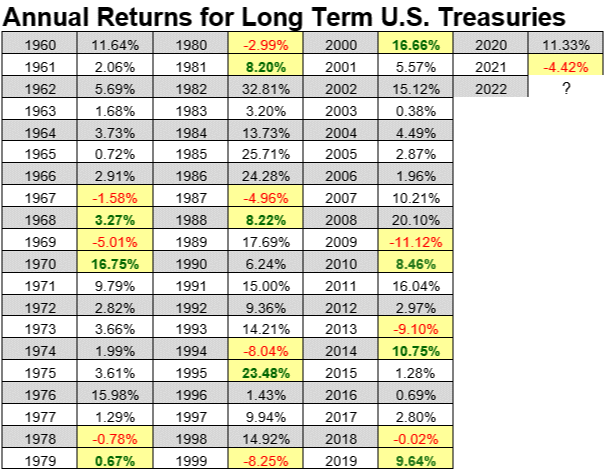

By the way, below is the annual long-term record of the US Treasury Bond. Note the reversions back to green following poor years.

So, why would we want to dump our bonds now?