Just a quick reminder…

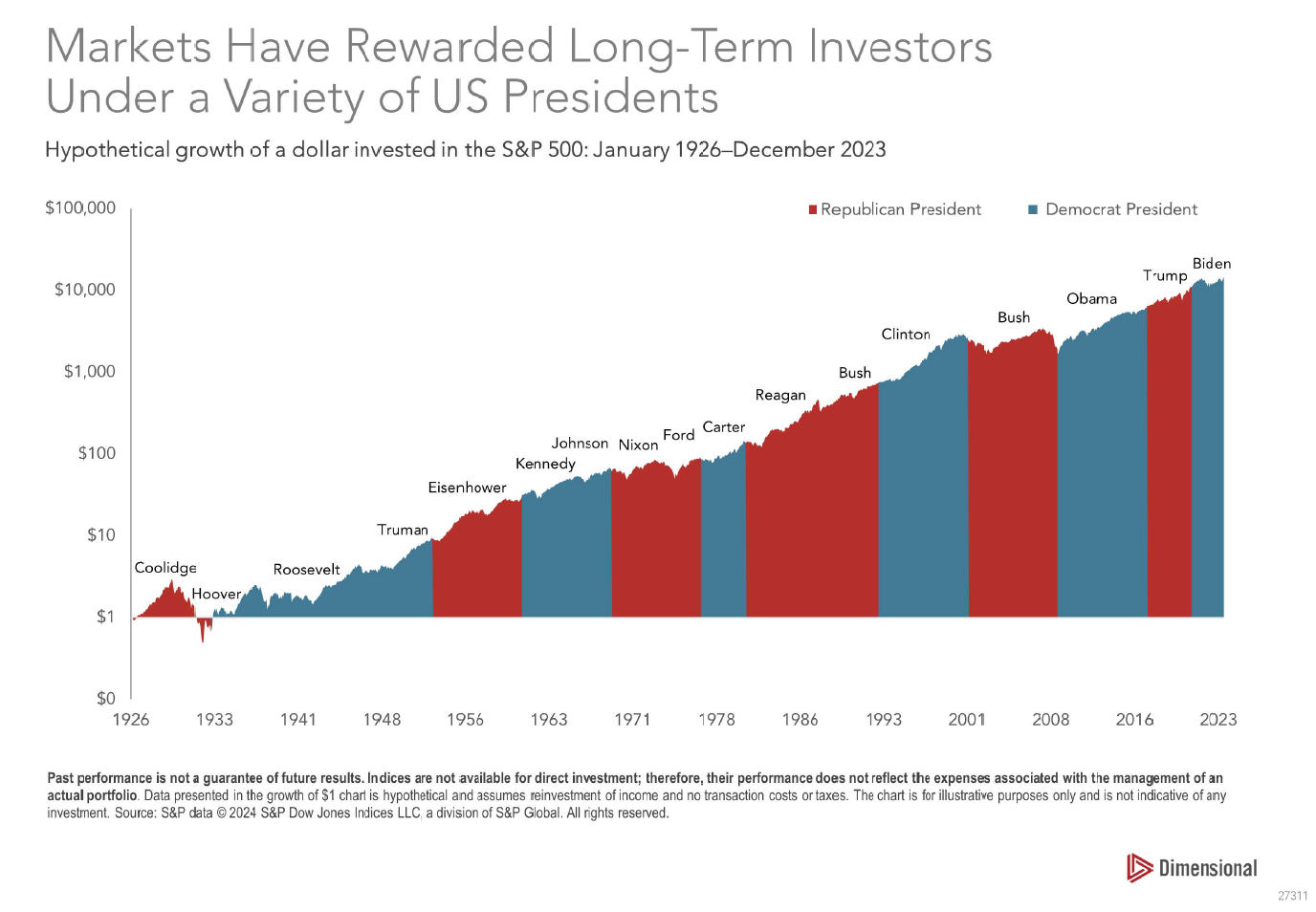

Every four years, tensions rise among some investors as to how their hard-earned savings will be affected by the upcoming presidential election. Without going into the details, know that there is no historical evidence we can use to reliably predict how our investment portfolios will be affected in the case of one candidate or the other being victorious. None. It’s just not there. As the illustration below from our friends at Dimensional Fund Advisors shows, the stock market does not really care who is in the White House – over time it just wants to go up!

Of course, markets will be volatile during times of uncertainty but predicting what will happen in the short run is gambling. Conversely, sticking with a sound investment strategy is a proven method of growing wealth. Remember: Fear and greed are the enemies of a good investment strategy.

So, as we approach the date of one of the most interesting presidential elections ever, we wanted to encourage everyone to do two things:

- Please exercise your inalienable right and cast a vote for your candidate of choice.

- Please resist all temptation to change your long-term, fundamentally sound investment strategy based on concerns about the outcome of this election.

See you at the polls!

Personal Anecdote:

Having been in the business of advising clients on investing for the last nine presidential elections, the only reliable indicator I have witnessed is that investors who based decisions on concerns over those elections were consistently wrong – and it usually cost them money as the markets moved ahead while they sat on the sideline. George