The Federal Reserve announced it is ‘leaning’ towards another interest rate cut in December, making the third cut in 2024. This has led to an abundance of financial media headlines like “3 Smart Moves For Investors After the Fed’s Interest Rate Cut.”1

Understandably, investors want to know what the implications are for their portfolios and if any changes should be made.

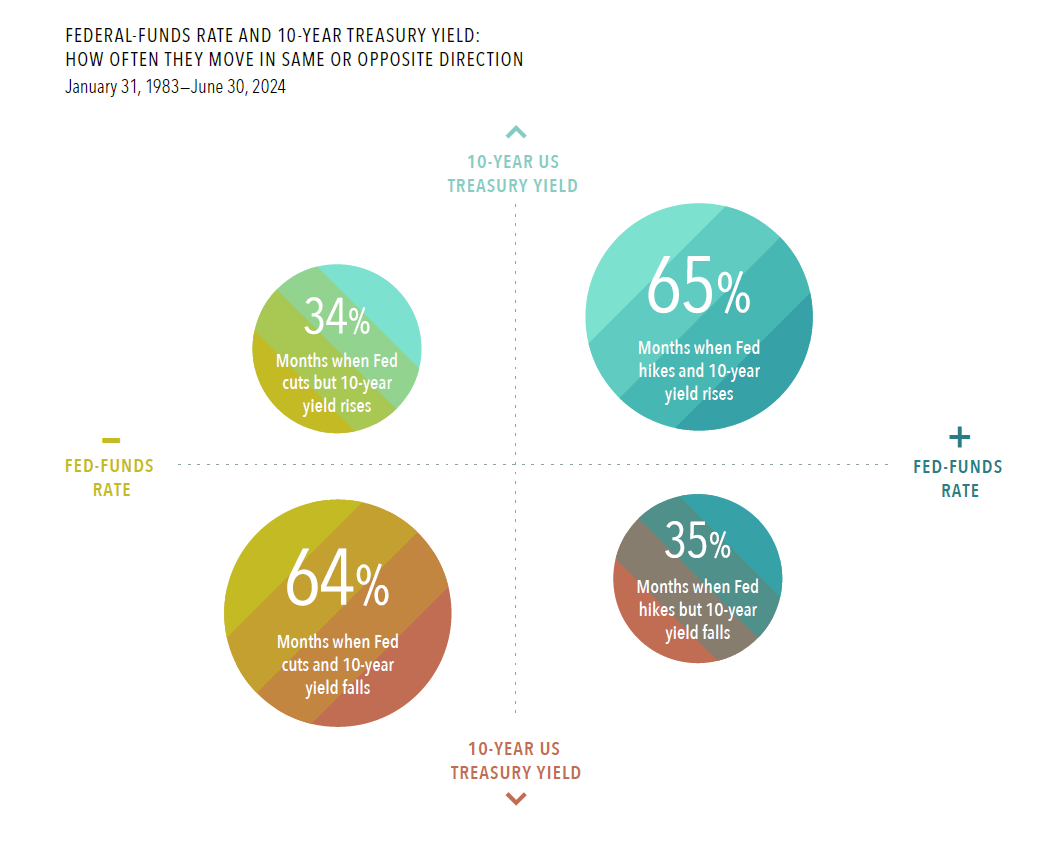

The infographic below2 from Dimensional Fund Advisors, a global investment management firm we use for research, examines a critical distinction: while the Fed controls the federal funds rate (the most short-term interest rate), the market sets the yield on longer maturity bonds, such as the 10-year Treasury Note (a key benchmark for the bond market). Surprisingly, these two rates don’t always move in the same direction.

The reason for this is simple – Federal Reserve policy sets the Federal Funds Rate used for overnight lending between banks to meet banking reserve requirements. While this has a trickle-down effect on the cost of borrowing and spending throughout the economy, it is not the largest driver of rates for longer-term bonds.

For longer durations, the financial markets – by way of investor actions – determine the level of rates based on what buyers are willing to pay for government or corporate bonds. These rates are heavily influenced by economic conditions and GDP growth, inflation expectations, and global events. This makes predicting market behavior based solely on Fed rate changes unreliable.

So how does this impact you? At BCM, our approach is to allocate client assets in a way that is not dependent on short-term changes in interest rates, or any other single market driver, but positions portfolios for resilience through a wide array of ever-changing market environments.

As an example, our balanced and conservative strategies manage interest rate risk by owning fixed income across varying durations, both intermediate and long-term. This helps to spread the effects of changes in interest rates across the yield curve.

As news on interest rates continues, remember the importance of diversifying across different fixed income durations as a long-term approach to investing.

If you have any questions, always feel free to reach out.

______________________________________________________________________________________________________________

1https://money.com/fed-rate-cut-investors-advice/

2 Past performance is no guarantee of future results. Investing risks include loss of principal and fluctuating value. There is no guarantee an investment strategy will be successful. Increases (+) and decreases (—) in the federal-funds rate and 10-year Treasury yield refer to monthly changes. Source: Federal Reserve Economic Data (FRED) from the Federal Reserve Bank of St. Louis. Data series used: Market Yield on US Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis, Percent, Daily, Not Seasonally Adjusted (DGS10); Federal Funds Target Rate (DISCONTINUED), Percent, Daily, Not Seasonally Adjusted (DFEDTAR); and Federal Funds Target Range – Upper Limit, Percent, Daily, Not Seasonally Adjusted (DFEDTARU). Circles corresponding to a rate cut do not sum to 100% due to monthly periods of no yield change for the 10-Year US Treasury note. Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission. Investment products: • Not FDIC Insured • Not Bank Guaranteed • May Lose Value Dimensional Fund Advisors does not have any bank affiliates.