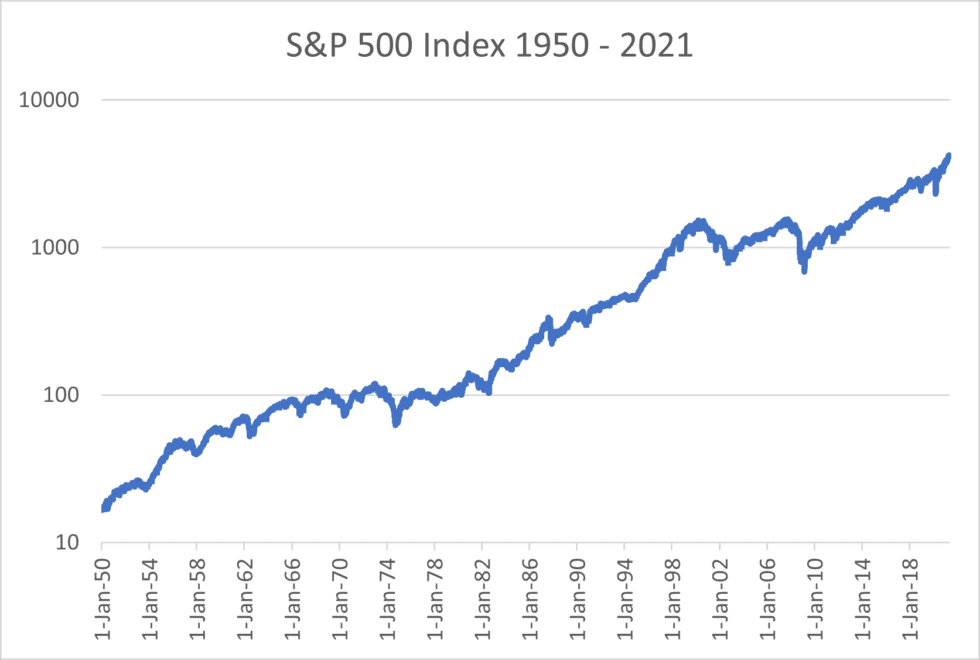

In 1950 – to pick a year at random -the S&P 500 index stood at 16.66. Today it stands at 4155.86. That is an increase of 24,845%, and that’s before dividends are included.

How could anyone have possibly lost money during that period???

That question is not rhetorical. While a successful investment outcome is simple in theory, in practice it’s anything but. Our behavior works to undermine us at every turn. Since there is no vaccination to protect us from ourselves, investment obstacles such as fear, greed, impatience, lack of discipline are impulses against which we must fight daily. Understanding and accepting this is really important.

Here are just a few simple thoughts which may help those wanting the greatest odds for investment success.

Maintain a Long-Term Time Horizon

What happens day to day is noise, and nothing more. Stocks are up 100 points, down 100, so what? Short-term market noise will have absolutely no bearing on your long-term investment results. None. Don’t waste your time thinking about it.

“Every decision we make is filtered through our long-term time horizon, even when it negatively impacts our short-term results. A long-term time horizon, coupled with patient capital, is a sustainable competitive advantage that is very difficult for many other market participants to duplicate.” CT Fitzpatrick

While You Can’t Predict, You Can Prepare. Allocate for Uncertainty.

Since no one has actually ever visited the future, it’s pretty silly for forecasters to tell us all about it. As Charlie Munger put it, “People have always had this craving to have someone tell them the future. Long ago, kings would hire people to read sheep guts. There’s always been a market for people who pretend to know the future. Listening to today’s forecasters is just as crazy as when the king hired the guy to look at the sheep guts. Yet, it happens over and over and over.”

“Accepting that we cannot predict the future – i.e.; there will always be unexpected and highly consequential events – is the first step to becoming less fragile and more adaptable. People should be highly skeptical of anyone’s, including their own, ability to predict the future and instead pursue strategies that can survive whatever may occur.” Seth Klarman

Keep it Simple

I know you’ve heard this before, but it is a universal truth. It can’t be said enough.

“A simple portfolio is actually the ultimate in sophistication. It almost always lowers cost, lowers taxes, makes analysis easier, simplifies rebalancing, simplifies tax-preparation, reduces paperwork and record-keeping, and enables caregivers and heirs to easily take-over the portfolio when necessary. Best of all, a simple portfolio allows the investor to spend more time with family and friends.” Laura Dogu, co-author of “The Boglehead’s Guide to Retirement Planning”

Check Your Emotions

This brings us full circle back to where we started. Control your emotions and behavior, and you’ve got it licked. Let your emotions rule, and you haven’t got a chance. They’ll get you every time.

“The hardest work in investing is not intellectual; it’s emotional. Benign neglect is, for most investors, the secret of long-term success.” – Charley Ellis

*******************************************************

Remember these four attributes. They are timeless and unchanging. They are shared by all successful investors. Ignore them at your peril.