The sky is (still) falling! No, really, it is. Just look around. Political discord, Covid, rising inflation, ever growing spending and federal debt levels, geopolitical threats from China and Russia. Did I miss anything? Oh yeah, Islamic Jihad.

With all of these worries, how can we prepare for the coming (your fear here)? What should we as investors do?

Our advice – nothing. Absolutely nothing.

The end has always been nigh. There has always been something really big to worry about. That being the case, the only question that matters is, can your portfolio design get you through (your fear here)?

************************************************

As you may know, we believe in a balanced, indexed portfolio. It holds asset classes that are generally economically non-correlated. That means they can rise or fall commensurate with the economic climate we find ourselves in.

So, Ignore Everything

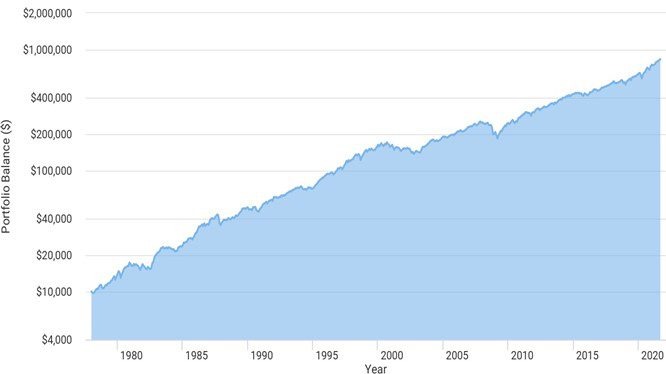

For many years now, I have been cataloging the biggest worries of the year, starting back in 1972. I’ve also cataloged how the indexes used to build a balanced portfolio performed over that same period of time, troubles not-withstanding. Here’s the updated list, through 2021.

History Revisited

50 Reasons Why People Got Scared Out Their Investment Plan.

- 1972 Dow Tops 1000 – Market too high

- 1973 OPEC Oil Embargo

- 1974 Watergate, Impeachment, Nixon Resigns

- 1975 Deep Recession in Progress

- 1976 Limits to Long-Term Growth

- 1977 Inflation Increases

- 1978 Interest Rates Rise Dramatically

- 1979 Iranian Revolution – Oil Prices Soar

- 1980 Interest Rates and Inflation Soar

- 1981 Deep Recession Begins

- 1982 Recession Worsens

- 1983 Market Prices too high

- 1984 Record Federal Deficits

- 1985 Economic Growth Slows

- 1986 Dow Nears 2000 – Market too high

- 1987 Black Monday – Market Crashes 20% in One Day

- 1988 Savings and Loan Crisis

- 1989 Bank Failures Increase

- 1990 First Persian Gulf War

- 1991 Dow Tops 3000 – Market too high

- 1992 Global Recession

- 1993 Hillary Clinton’s Health Care Reform

- 1994 Mexican Currency Devaluation

- 1995 S&P 500 tops 629 – Market too high

- 1996 Greenspan warns of “Irrational Exuberance”

- 1997 Asian Financial Crisis

- 1998 Russian Currency Devaluation

- 1999 Presidential Impeachment

- 2000 Technology & Dotcom Meltdown

- 2001 9-11 Terrorist Attacks

- 2002 Corporate Malfeasance – Enron & WorldCom

- 2003 2nd War in Iraq, SARS virus

- 2004 Decline of Dollar

- 2005 Hurricane Katrina

- 2006 Rising Gas Prices

- 2007 Subprime Mortgage Crisis

- 2008 Credit Collapse and Great Recession

- 2009 Collapse of Major U.S. Financial Institutions

- 2010 European Debt Crisis – Greece

- 2011 Downgrade of U.S. Debt

- 2012 Extreme Political Polarization in U.S.

- 2013 Mideast Turmoil and Wars Escalate

- 2014 ISIS Terror Escalates – Ebola virus

- 2015 Oil Prices Collapse – Isis Strengthens

- 2016 Extreme Political Election Acrimony

- 2017 Dow nears 25,000 – Market too high

- 2018 Rising Rates, Trade Wars, Political Disfunction

- 2019 Presidential Impeachment, Slowing Global Growth

- 2020 Coronavirus Pandemic – Polarized Electorate

- 2021 Inflation Increases, Fed Taper (again…)

And now, 1 Good Reason Not to Abandon Your Plan

Balanced Index Allocation, 60% US Stocks (Total Market), 20% Intermediate Term U.S. Govt. Bonds, 10% Long-Term U.S. Govt Bonds, 10% Gold, rebalanced annually. This is not a portfolio; it is the outcome of the underlying indexes, used in the percentages shown. You cannot invest directly in an index. Past performance of indexes represented may not reflect future results.

Well, there you go.

By holding an indexed, diversified allocation to asset classes that are economically sensitive, and whose performance are often independently (and negatively) correlated to one another, you get a performance profile that has “fallen forward” over time.

But here’s the trick. For this portfolio to “work”, you need to give it time, and the stool needs to stand on all four legs. Whatever leg(s) may be penalizing total portfolio performance today, the design is such that the other legs should take up the slack. And since the efficacy of the legs change throughout the economic cycle, trying to micromanage the allocation, or even pay attention to what the individual legs are doing today is not productive.

So, unless you have privileged information regarding the future, maintain your discipline. Don’t try to outguess the unknowable. That is our recommendation to all.