When it comes to document retention, it is easy to get overwhelmed figuring out what to keep and what to discard. Often, we resort to keeping EVERYTHING. But in this digital age, with online statement and document retrieval, what we need to keep on hand has decreased considerably. To get you started on the process of clearing out those filing cabinets, we have put together some general guidelines.

Start by making three piles:

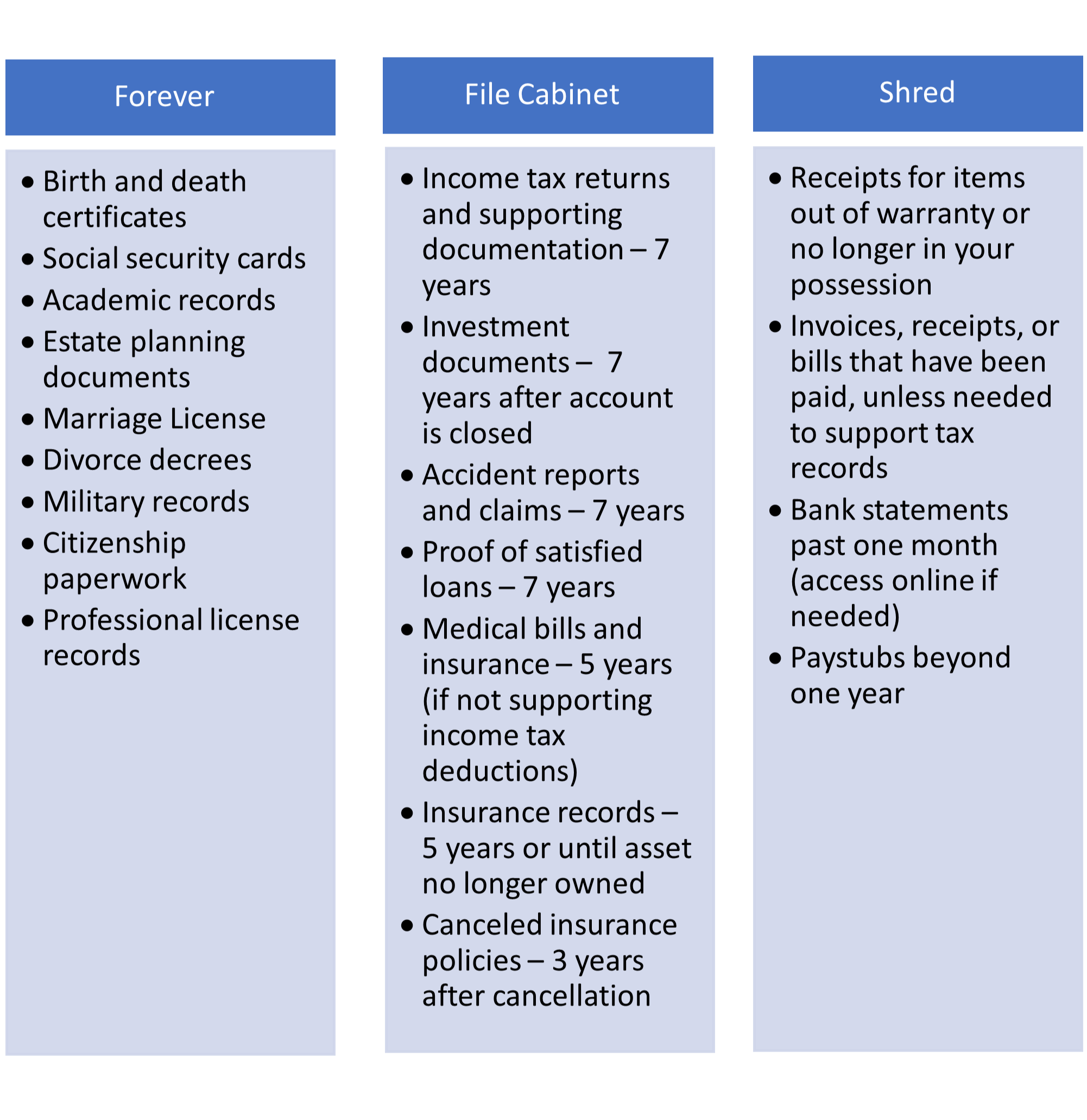

- Forever

- Documents that should never be discarded.

- Housed in a home safe, bank vault, or fireproof document holder.

- Long Term Storage

- “Filing cabinet” documents.

- There are few absolutes on record retention, but the consensus is that seven years is sufficient for most financial records.

- Shred

- Many documents require far less storage time than seven years.

- May keep these for a month or until records are reconciled and/or bills are shown as paid.

- Easily accessed digitally if needed.

Stay on course by switching to paperless when possible, shredding documents consistently, and performing an annual retention purge. And remember, these are just guidelines. You should always reach out to the appropriate professional if you have questions about handling specific documents.

Oh, and if that shred pile is too big for your home shredder, bring it by the office. We’ll happily “lighten your load!”