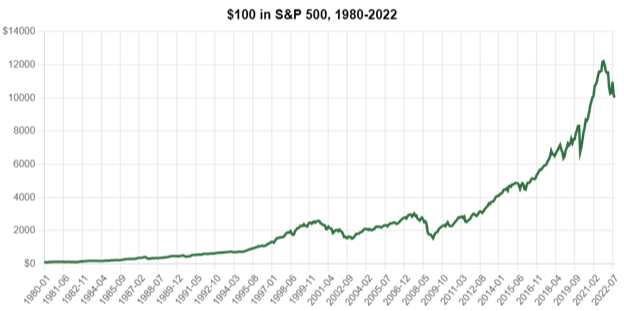

Source: S&P Dow Jones Indices, LLC

If a picture is worth a thousand words, the above chart says it all.

Starting in 1980, $100 invested in the S&P 500 stock index grew to more than $10,000 so far. That represents a total compounded return of roughly 11.4% per year.

So, getting rich in the market should be easy, right? Buy it, hold it, and let it work for you.

Well, in theory, yes, getting rich in stocks is easy with the above long-term point of view.

In practice, not so much.

That is exactly why not all investors have enjoyed the theoretical success that the above chart portrays.

How many times have we counseled that investment success boils down to our investment behavior? IT IS THE MOST IMPORTANT THING – BY FAR – THAT CAN HAVE A LASTING EFFECT ON OUR LONG-TERM RESULTS.

*************************************

Looking at the above graph, it’s easy for your eye to start at the beginning ($100) and then to jump to the end ($10,000). But as with most things, the devil is in the details.

Specifically, there were several bumps along the way, all of which held out the chance for the undisciplined investor to derail himself.

Squint your eyes and look carefully at 1987. Note the slight drop in the growth curve. That was the infamous Crash of 1987. Scary when experienced over that three-month period (I was there), but utterly inconsequential when viewed through the lens of a longer-term perspective.

Same for the bear markets of 2000-2002, 2008-2009 and 2020 (Covid).

An investor who allowed those then-current events to blow him/her out of the water risked missing out on the long-term fabulous gains that the markets delivered once the crisis of those periods passed.

The real risk present in the financial markets is not whether there may or may not be another 20% or so downside over the next ensuing months, but rather, missing out on the next 100%, 200% or whatever percent the markets likely will offer in the years to come, as they have in the past.

Don’t let today’s short-term troubles take your eye off of the bigger picture. Remember the ultimate outcomes for those who hung tough through 1987, 2000-2002, 2008 and 2020. Their discipline, and yes, courage, paid off in spades. That’s just how the financial markets work. They shake out the weak and reward the disciplined.

So, how do we get through this current period intact?

As we have said many times, quoting master investor Charles Ellis, “benign neglect is the secret to long term investment success”.

Easy to say, sometimes hard to do, but the record is hard to argue against (see chart above).