In less than three months, the S&P 500 has broken through five market high milestones on five separate occasions1. As prices continue to climb, investors have become concerned that the stock market is too expensive. As of March 25, 2024, the S&P 500 costs approximately 28 times the earnings it produces. Compared against the long-term average (1871 – 2023) of 162, investors might be thinking twice about investing in the stock market.

“Is it time to go to cash?”

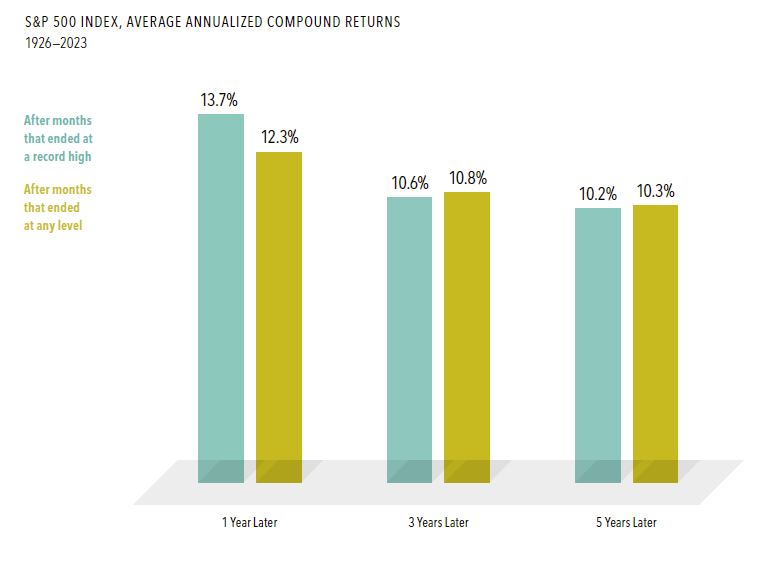

Historically, new all-time highs in the stock market have shown little effect on the near-term performance of the S&P 500. The chart below3 compares stock market performance following record peaks versus all other periods.

As you can see, the short-term implications (1 Year Later) do not suggest that reaching new highs is any indication of a coming course correction. Further, the difference in the longer-term periods (3 and 5 Years Later) is almost non-existent.

Long-term investors should take record high stock prices as neither good nor bad. If we expect the financial markets to continuously deliver long-term positive returns, stock market highs (regardless of timing or frequency) can provide ongoing evidence that this expectation is being met in real time.

If you have any questions, please feel free to give us a ring or email us at info@bcm-advisors.com.

1(yahoo!finance, 2024)

2(multpl, 2024)

3(Dimensional Fund Advisors, 2024)