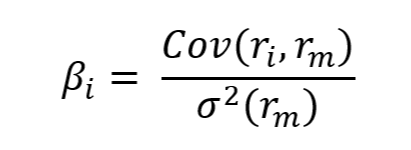

Academics define risk as “portfolio volatility”, which they call “beta”. They do that because they are, well, academics. By equating volatility to risk, they can assign Greek letters to their arithmetic, and write lots of academic papers on the subject.

The formula for Beta

Clearly, your estimate of beta will depend upon

Your choice of a proxy for the market portfolio.

Got that???! 😊

More pedestrian investors such as Warren Buffet take a more pragmatic view. To these investors, risk is not volatility, but the possibility of permanent loss of your capital.

Permanent loss – that’s what matters.

While individual companies can and have gone bankrupt, no major stock market index has ever done so1. Even through the worst of times, the indexes survived.

That’s just another way of saying that collectively, all publicly traded companies here in the U.S. have never gone away at the same time.

**************************

So, how does this apply to me?

If I’m saving for retirement, or building wealth that will outlive me, what risks should I be cognizant of?

In our opinion, it is time. Or said another way, “when will you need the money”?

Using historical market returns, we looked at the worst-case return record (1972 – 2024) of a balanced portfolio (60% U.S. stocks and 40% 10-year treasury bonds) that broadly represents many balanced portfolios of today2.

Period Average Cmp’d Return Best Case Cmp’d Return Worst Case Cmp’d Return

1 Yr 9.98% 54.27% -25.38%

3 Yr 9.79% 26.16% -5.26%

5 Yr 10.00% 23.56% -0.42%

7 Yr 10.07% 19.59% 1.87%

10 Yr 10.19% 16.38% 2.06%

15 Yr 10.16% 15.88% 5.68%

Here’s the takeaway – since 1972, the above data show that the total return of a balanced allocation has been positive beyond a 5-year time horizon.

So, if you have at least that much time or more before needing your money, your exposure to permanent loss of your capital by remaining invested in a balanced portfolio would seem to be minimal. In other words, the longer your time horizon, the more likely you are to have a positive return over that period and the less you should be concerned about short-term risk measures that are beyond anyone’s control (you guessed it – volatility).

***********************

A little different situation if you are retired and drawing from your portfolio.

This is where having an adequate cash reserve is critical to a financial plan. How much? Well, it could be as much as a few years’ worth of living expenses, depending on your total sources of income outside of your investment portfolio.

To really hone in on what is appropriate for you, you should consult with your advisor or financial planner for guidance. This is important, and it’s one of many areas where your advisor(s) can help in building a financial plan that complements your portfolio.

[1] (Longtermtrends, 2025)

[2] Balanced Index Allocation, 60% US Stocks (Total Market), 40% 10-year Term U.S. Govt. Bonds, rebalanced annually. This is not a portfolio; it is the outcome of the underlying indexes, used in the percentages shown. You cannot invest directly in an index. Past performance of indexes represented may not reflect future results. Results generated by Portfolio Visualizer.