Everybody wants to teach their kids the most important and valuable things in life. Money management is an essential life skill that is important at all ages. Whether you are a child or well into your retirement, there are important money skills that you can develop along the way to help you achieve financial success.

As a mother of twin 5-year-olds and a 2-year-old, I have recently begun teaching them essential financial skills that are appropriate for their age. These include identifying what costs more, distinguishing between wants and needs, and exploring ways to give to others.

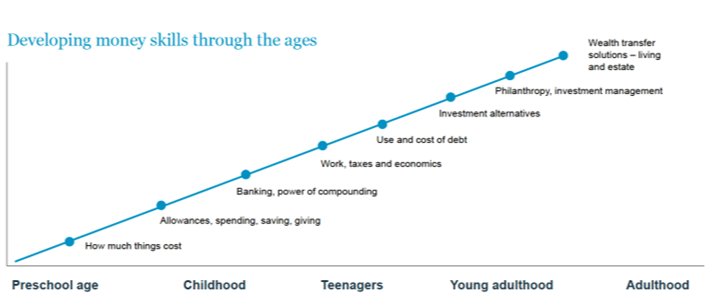

The chart above from Nuveen Education is a great visual for the progression of knowledge and skills over time.

Childhood:

- Understanding the value of money: Teach your children about the value of money by giving them an allowance or encouraging them to earn money through extra projects or a part-time job.

- Saving & Budgeting: Encourage your children to save money by opening a savings account and setting small goals. Help them understand the difference between needs and wants and how to prioritize their spending, saving, and giving.

Teenage Years:

- Building Credit & Avoiding Debt: Start building credit by opening a credit card. Set limits on purchases and avoid letting balances go unpaid.

- Investing: Start small, when time is on your side, and let the power of compounding work for you. It’s amazing!

Young Adulthood:

- Building Emergency Savings: Build an emergency savings fund to prepare for unexpected expenses or job loss.

- Saving for Retirement: Contribute to your employer’s retirement plan or open an individual retirement account (IRA).

Older Adulthood:

- Estate Planning: Construct an estate plan to ensure that your assets are distributed according to your wishes after your death.

- Long-Term Care Planning: Think about long-term care as one option you have to support your needs as you age.

We talk about these topics with clients all the time but breaking it into different stages of life makes it more manageable.

Bottom line: Money skills are important at all ages, and it’s never too early or too late to start developing good financial habits. BCM can help you learn and practice these essential money skills so you can leave your children and grandchildren more prepared! Reach out if you have questions or want to increase your financial literacy.