Let’s talk about money—it’s not just valuable, but it has a place for everyone in their daily lives. And on top of that—NOT having money discussions can be detrimental to your wealth.

Money has historically been an off-limit topic for families, even to the point of taboo. Money is a touchy subject for many—the source of deep emotions, conflicts, and anxieties. BUT, the money taboo keeps us ignorant of better habits, practices, and perspectives.

At the core, every conversation about money is also about values—what you are spending, saving, and giving. This provides an opportunity to educate our children on important values through our own personal spending decisions.

My husband and I have 4-year-old twins and a 2-year-old. They can’t grasp big concepts, but we can still start to instill open conversation and values about money now. As a family, I like to focus on two words—INCLUSIVE and SUSTAINABLE, meaning that everyone can have a role in the family money discussion, but it also needs to be something that both parents can stick to for the long term. This creates transparency, alignment, and trust on our money values with our children.

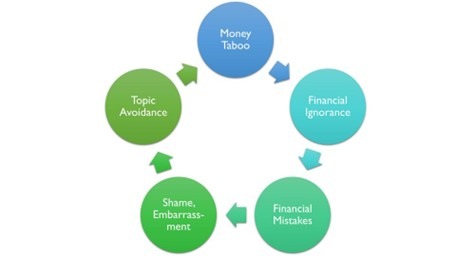

On the other hand, what if you do nothing? This can lead to the vicious cycle of Money Taboo—where financial ignorance turns to financial mistakes, which we naturally avoid talking about, strengthening the taboo over time.

GRAPHIC: BRETT WHYSEL

There is a saying that is common in America, “shirtsleeves to shirtsleeves in three generations.” It’s a global phrase. In Italy, they call it “from the stalls to the stars to the stall again.” In China, it’s “teacup to teacup.” What it means is that wealth made within a family will be lost in three generations! WHAT?! The surprising thing is that 85% of the cases are due to breakdowns in family trust or a lack of preparedness of the next generation, and only 5% of the time is actually a result of investment or business challenges.1

So, what can you do?

- Start with the people at the top—put money talk on the table between partners and identify values.

- Keep the conversation nonjudgmental. Give everyone the most generous interpretation of their questions, fears, and motivations.

- Find the appropriate way to include everyone at any age.

It is important to recognize that this is not an estate plan. The estate plan was written to take care of the assets, not the relationships. Legacies are built on relationships. And relationships are built on communication skills.

As an advisor, the best advice we can give is this—start the discussion. We realize that the estate planning in a family is only half of the equation. If you believe there might be room for education of family values and money, please give us a call. We would be glad to help develop a gameplan.

1 The Williams Group conducted a 20-year study of 2,500 families in combination with an extensive research project including another 750 families with the Miami of Ohio School of Business to determine why only one-third of families succeeded in retaining their wealth into the next generation.