On January 1, 2018, the Tax Cut and Jobs Act went into effect, creating sweeping overhauls to taxes for income, estate, corporations, and non-profit organizations. While the law has decreased taxes for most individuals and businesses, many of the provisions are scheduled to sunset on January 1, 2026.

To prepare, below are some of the major changes you should be aware of while working with your tax and estate professionals. Everyone’s tax situation is unique, so we highly recommend speaking to your CPA and Estate Attorney.

Estate and Gift Taxes

Currently, any estates or lifetime gifts under $13.6 million ($27.2 million for married couples) are below the exemption line before estate or gift taxes take effect. Once this threshold is reached, taxes on estates and gifts are assessed, ranging between 18% and 40% depending on size. While many investors might not be impacted today, the sunset will cut this exemption amount in half, bringing it down to approximately $7.15 million ($14.3 million for married couples) before taxes kick in.

For those with estates currently over $7.15 million ($14.3 million for married couples), it would be a good time to speak to your estate attorney about strategies for minimizing your estate tax and gift tax exposure. This can be done in a variety of different ways such as gifting or moving assets outside of your estate.

Personal Income Taxes

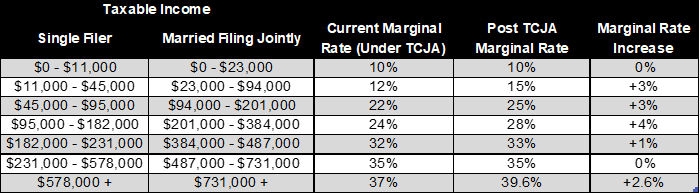

Along with estate and gift taxes, there will be impactful changes to personal income taxes. Income rates will go back to pre-TCJA levels, increasing most income tax bracket rates between 1 and 4%.

Additionally, there will be changes to deductions. Receiving a deduction for moving due to a work relocation will be available to everyone again, not just the Armed Forces. The standard deduction will be reduced by almost half. Currently, the standard deduction for those married filing jointly is $29,200 and will be reduced to $16,200 in 2026. For itemized deductions, the state and local tax (SALT) deduction will no longer be capped, personal casualty and theft losses will not be restricted to only federally declared disasters, mortgage/home interest deductibility increases from $750,000 of debt to $1,000,000 of debt, among other changes.

Some positive news, while there will be an increase in rates and drop in the standard deduction, personal exemptions will return, providing a $5,300 per person (for self, spouse, and child). This could help to offset the negative changes to income taxes. Lastly, there will be two major changes for income tax credits. The child tax credit will decrease from $2,000 to $1,000 per child. The Premium Tax Credit for Health Insurance will have an income limit of $78,000 to help to offset the high costs of health insurance premiums. For those that are currently on a healthcare plan offered through healthcare.gov, we highly recommend reviewing the impact on your health insurance premiums before the law sunsets in 2026.

Alternative Minimum Tax (AMT)

For higher income taxpayers, you may be subject to an alternative income tax system if you:

- Exercise Incentive stock options.

- Receive Tax-exempt interest from certain bonds.

- Claim Depletion and accelerated depreciation on certain leased personal or real property.

- Claim Intangible drilling costs.

This alternative tax system was put in place in 1969 to provide a floor on the percentage of taxes that high income filers must pay to the government. The TCJA significantly reduced the number of taxpayers subject to the AMT by increasing the AMT exemption amount.

This exemption amount will return to pre-TCJA levels in 2026, meaning a larger number of taxpayers might be subject to the Alternative Minimum Tax structure, which typically increases income taxes owed.

Qualified Business Interest Deductions

For businesses, there are two major changes to consider for business owners. First, the 20% Qualified Business Interest deduction is scheduled to end in 2026. It permits certain pass-through entities (e.g., S corporations, LLCs) to deduct up to 20 percent of their business income, although it is subject to certain limits and income thresholds.

Second, bonus depreciation for businesses will be changing. In 2023, businesses could take 80% first year bonus deduction (full expense), phasing down 20% each year for 5 years. In 2024 it will be 60%, 2025 40%, and 2026 20%. In 2027, normal depreciation rules will apply.

While the above covers the highlights of the upcoming changes, there are others to consider. We highly recommend calling your CPA and Estate Attorney to determine how the upcoming changes of the TCJA will affect your personal situation.

If you have any questions, please feel free to give us a call.

Citations:

Congressional Research Service – https://crsreports.congress.gov/product/pdf/R/R47846