Following up on our recent blog – Resolute, Part I – The Stock Market – we now shift our focus to bonds.

There’s a tenet of investing known as the Risk/Return Tradeoff. Simply put, the more inherently risky an investment is, the higher the potential return (this is because investors need to be incentivized to take greater risks and expect to be rewarded for doing so). Conversely, the lower the risk, the lower the return potential.

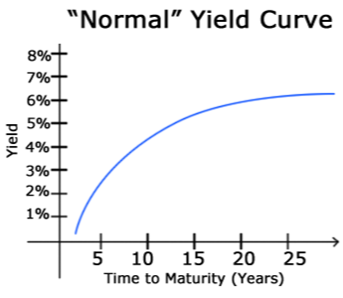

For bonds, the longer the duration (e.g., a 20-year bond versus a 3-month bond), the higher the risk. By tying up your money for longer periods, you forgo other investment opportunities that may come along. Therefore, investors should be compensated for their long-term commitment.

This is a general principle, but it does not always hold true.

In March 2022, the Federal Reserve began raising short-term interest rates in response to rising inflation. This resulted in a steeply inverted yield curve. In the simplest terms, this means short-term interest rates rise faster and become more desirable than long-term rates, a departure from the risk-return tradeoff described above.

While this helps to slow down spending and combat inflation, it can also have a negative impact on investors holding bonds. As new bonds are issued at higher interest rates, the prices of existing bonds decrease because they become less attractive.

The challenge to long-term investors, then, has been two-fold:

Longer duration bonds have experienced a steeper drop in price than their short-term counterparts, all the while short-term bonds are suddenly paying higher interest rates.

It can be tempting in these circumstances to abandon bonds altogether, or to focus on higher-yielding short-term bonds to capitalize on those higher rates. Here’s why it’s important to stay the course:

First, the Fed’s actions have driven up yields across all durations. For passive, long-term investors using vehicles such as passive index funds, maturing bonds are replaced by newly issued bonds with higher yields, increasing an investor’s interest income.

Second, yield curve inversions are infrequent and temporary phenomena, lasting on average less than one year. When inflation eases or economic growth shows signs of slowing, the Fed shifts to a more accommodating interest rate policy, resulting in a correction of the yield curve inversion (at least, it always has historically). As a result, long-term bond holders, the ones who suffered the heaviest drawdowns, stand to benefit the most from price appreciation as the risk/return tradeoff is restored.

Thinking “Long-Term”

One of the primary roles of fixed income in a portfolio is to be a differentiator from equities. While bonds exhibit less volatility on average than stocks, their performance in absolute terms or in comparison to stocks cannot be predicted or timed. While this can seem unpredictable by itself, bonds coupled with equities can reduce total portfolio risk while continuing to generate interest income.

Rather than trying to determine when to add or reduce exposure to bonds or how to capitalize on interest rate changes, disciplined investors will benefit from holding firm to a strategic, long-term allocation that allows them to capture the positive impact of the risk/return tradeoff over time.

If you have questions about bonds or any of the positions in your portfolio, please give us a call, and we’ll be happy to discuss in greater detail.