The events of the last few weeks are certainly unsettling, but unfortunately not unprecedented. Whether we are talking about Iraq’s invasion of Kuwait, the start of the Korean War, the Cuban Missile Crisis, or Pearl Harbor, a similar pattern of reaction in the financial markets can be observed.

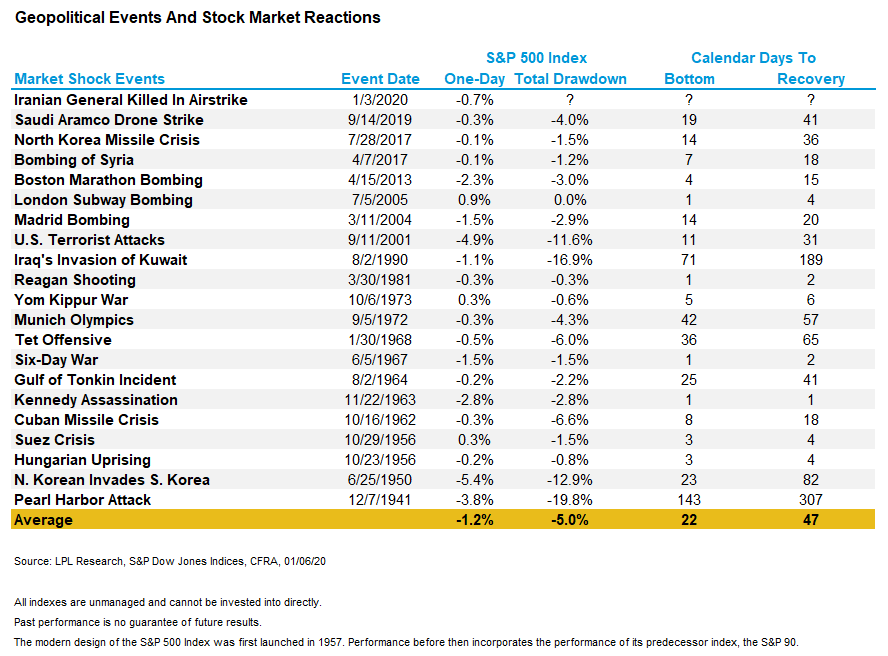

There is always an initial decline in response to the event (we are obviously experiencing that now). Looking at the chart below, we can see that the total market downturns in response to whatever event we are cataloging has ranged from less than 1% to as much as 20% (Pearl Harbor). The 1990 Gulf War saw a market decline of 16.9%.

While the average time from an “event” to a market bottom has been 22 days, it obviously can also be longer. In the case of the Gulf War, it took 71 days.

Since the time it took for the financial markets to find a bottom following these geopolitical shocks is measured in days (certainly not years), we need to consider how they recovered. To give a couple of examples, just one year after the 1990 Gulf War began, stocks were ahead 25%. For the Korean War, which started in 1950, by the time it ended in 1953 the Dow was up nearly 60 percent – an annualized growth rate of 16 percent.

While every event is unique, including the Russia-Ukraine war, and while no one can say exactly what will unfold over the next few days or weeks, a review of world and market history tells us that those who kept their heads during a panic prevailed. That is why we recently posted the following blog – A Timeless Lesson – Don’t Miss the Forest for the Trees.

We obviously hate what is happening for many reasons. But while we can’t control events themselves, we can control how we react. History suggests that keeping a cool head and staying the course with an excellent investment strategy is what we need to be doing right now. It is why we call our approach to investing All Weather.