Charlie Ellis, called Wall Street’s wisest man by personal finance columnist Jason Zweig of the Wall Street Journal, is a renowned investment consultant I have quoted many times. The thrust of his advice (indeed, he wrote the book on it) is for investors such as us to avoid the Loser’s Game by indexing our exposure to stocks and bonds, playing the long game, and, most importantly, understanding our emotions and managing our behavior. One of my favorite Ellis quotes is: “The hardest work in investing is not intellectual; it’s emotional. Benign neglect is, for most investors, the secret of long-term success.” Excellent advice. Unbelievably hard to put into practice.

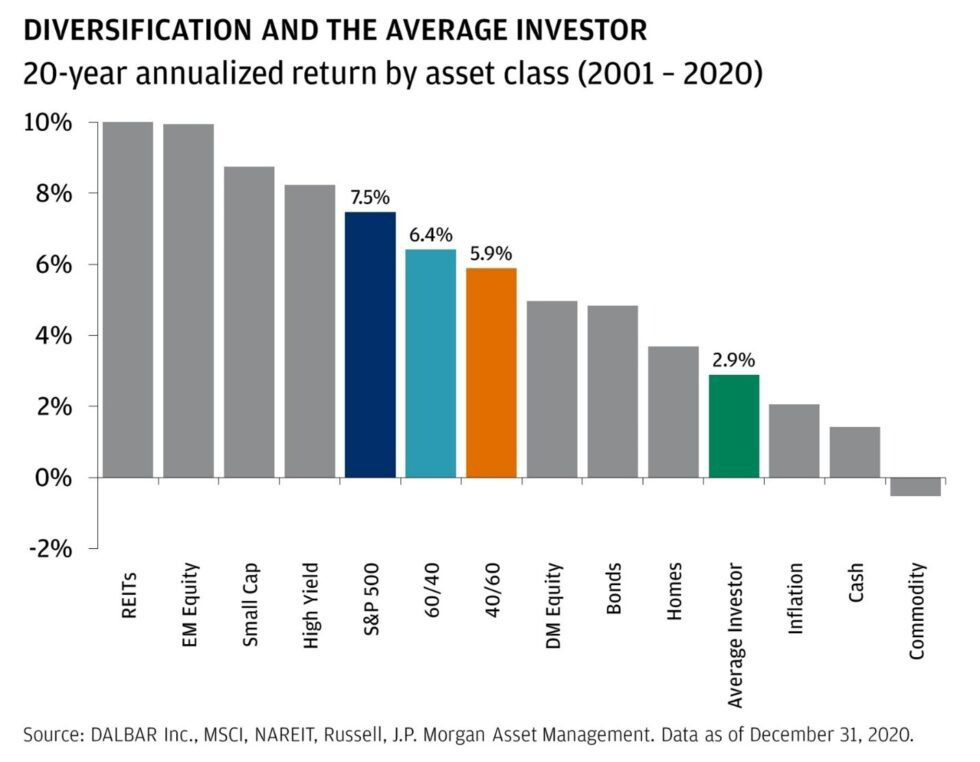

The graphic below shows what can happen when the “average investor” ignores Ellis’ advice and looks to take shortcuts (aka – bad investment behavior). Over a twenty-year period (2001 – 2020), the annualized performance of a 60/40, stock/bond portfolio (shown in light blue) delivered annualized returns of 6.4%. By comparison, the “average investor” (shown in green), due to poor behavior, realized just 2.9% annually – a material difference.

We are once again being tested. It seems we can’t even buy a piece of good news, and the world’s turmoil is being reflected in the financial markets.

But understand this: Nothing stays the same. Just when it looks darkest is when things often change, and such turning points do not generally announce themselves in advance. This is when our behavior really matters – where the rubber meets the road. These are the times that might determine whether we ultimately realize the full benefit of the aforementioned 60/40 portfolio, or we settle for the results of the “average investor”.

It’s tough. It can be exhausting (especially if you follow it too closely). But there are no short-cuts if we want to emerge successfully on the other side of the storm. That is why we have written about this so much over the last several months (see links below).

Hang tough – this too shall pass.