Don’t Assume That Cash is King for Long-Term Investing

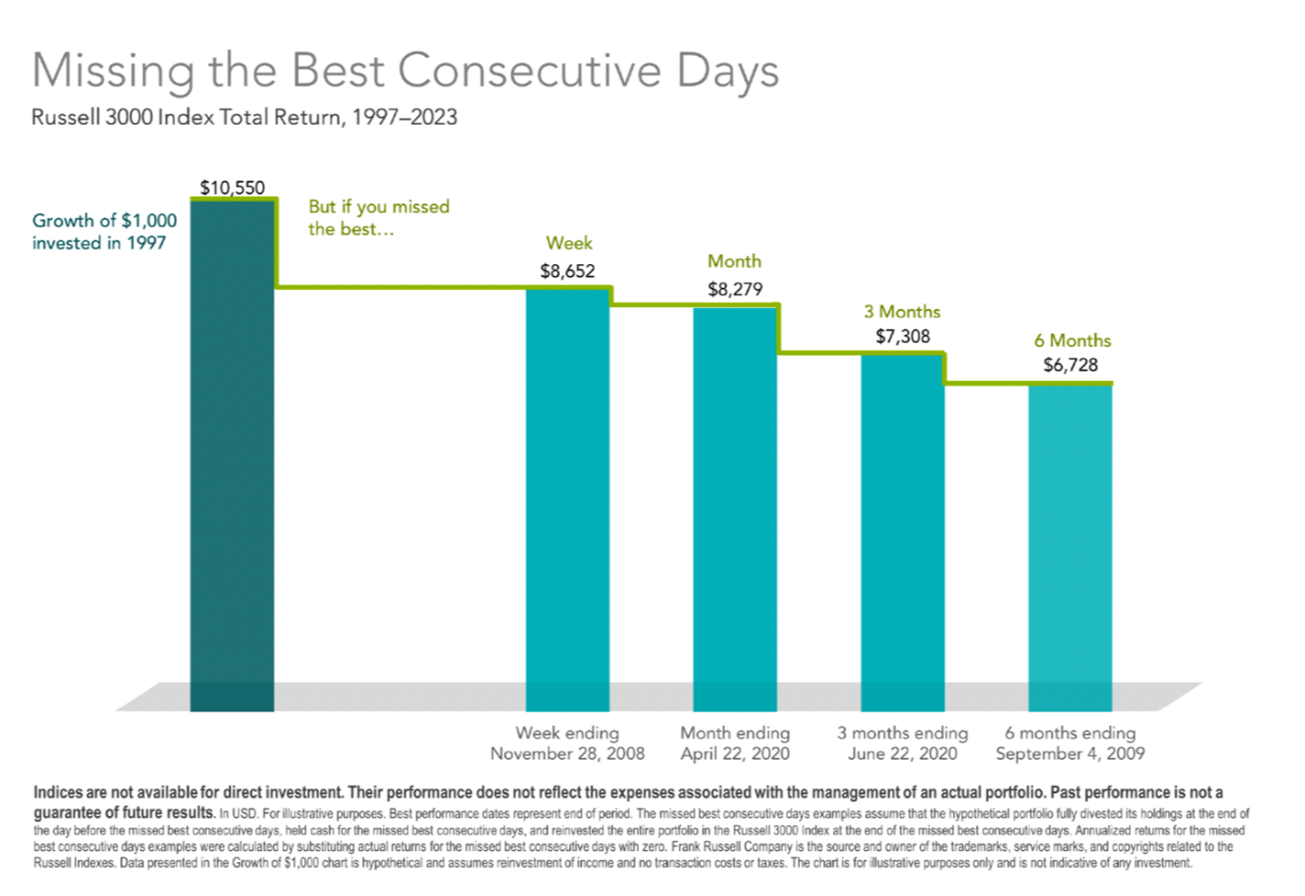

The image below highlights a critical concept: the opportunity cost of holding cash instead of investing in the stock market long-term. The picture shows the dramatic impact of missing the best consecutive rally periods on a $1,000 initial investment between 1997 and 2023. Staying invested in the stock market during this time yielded a growth to $10,550. However, if you missed the best week, month, 3 months, or 6 months, this drastically reduces that number.

Source: Dimensional Fund Advisors

Some clients question the rationale of being invested in the market versus holding cash. After all, cash investments are yielding approximately 5% annually with no volatility…what is not to like?

While the opportunity cost of investing in cash is low over the short-term, it is much higher over the long-term. Between 1997 and 2023, cash has underperformed the stock market on average by 8% annually. Over time, this differential adds up exponentially, totaling more than 700% over 20 years1.

Cash, while stable, does not benefit from growth opportunities like equities. The stock market’s volatility can deliver significant gains in a blink of an eye and missing these periods can lead to significantly lower long-term returns. Additionally, cash holdings can lose value over time due to inflation, while stocks have traditionally outpaced inflation2.

Four Things to Promote Good Long-Term Investing:

- Look at the Big Picture: Markets go through cycles. Don’t miss the recovery for fear of short-term volatility.

- Stay Invested: Timing the market is notoriously difficult and missing even a few key days can drastically impact long-term returns.

- Keep Diversified: A well-balanced portfolio can help mitigate the impact of volatility while staying positioned for growth. Diversification is key.

- Determine the Cash You Need: For most, this may be 3-6 months of expenses (for those in retirement, it may be more). Any cash above this amount should be invested in financial markets.

Benjamin Graham said, “The best way to measure your investing success is not by whether you’re beating the market but by whether you’ve put in place a financial plan and a behavioral discipline that are likely to get you where you want to go.” Stick to your plan, align your strategy with your financial goals, and avoid market timing (both getting in and out of the markets!).

If you need help optimizing your portfolio allocation, give us a call.

Sources

1 Creative Planning, Data as of 12/31/2022, Cash Proxy- 3 month treasuries, Stock- US Large Cap

2Dartmouth Data Library (https://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html)