Earlier this year, the Social Security Board of Trustees released their annual report on the solvency of Social Security benefits. Over several years, the Board of Trustees has continued to report on funding issues for fulfilling long-term benefits. Unfortunately, this information has been extrapolated, creating news headlines such as this one from June 1:

“Social Security is in trouble: Checks could be cut 23% by 2034”

While headlines like this do a good job of capturing one’s attention, they strike fear and unfortunately have led some to claim retirement benefits early without fully understanding the consequences. Not only does claiming before full retirement age reduce one’s annual benefits permanently, but it can also create additional taxes, further reducing the benefit. Considering this, we thought providing some good information would be helpful when considering your Social Security claiming strategy.

Current Health of Social Security Benefits

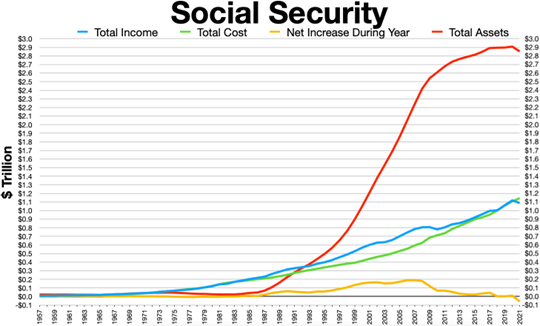

Since 2010, the report from the Social Security Board of Trustees has found that annual program expenses (retirement benefits, disability benefits, Social Security Administration costs) are exceeding program income (payroll taxes, Social Security benefit taxes and investment interest from the Social Security Trust Fund). When expenses exceed income, the difference must be made up from the Social Security Trust Fund. The Social Security Trust Fund was established in 1940 as a funding mechanism for the expansion of Social Security benefits to spouses, children, and surviving family members.

This deficit has been attributed to increasing life expectancies (leading to longer benefit payouts), a decreasing workforce and historically low tax rates (reducing expected income to pay for benefits). The chart below shows how income (blue line) has dipped below expenses (green line), causing funds to be drawn from the trust (red line). In 2022, 90% of Social Security benefits were covered by payroll taxes and 10% was covered by income from the Social Security Trust Fund.

Under these conditions today, the projections show that this is not sustainable, unless changes are made.

Current and Pre-Retirees (Ages 60-100)

Funding issues are not new to Social Security. A similar situation happened in 1982, when the trust fund was almost fully depleted. The Social Security Amendments Act of 1983 increased federal payroll taxes and pushed back the full retirement age from 66 to 67 for those born after 1959. While these changes increased taxes and may have delayed retirement plans for many, it allowed Social Security to pay out 100% of retirement and disability benefits.

However, what if they don’t make a change? Even if no change is made to this ever-concerning issue, some benefits can be paid even if the Social Security Trust Fund is depleted. The Social Security Administration states that if no changes are made, continuing income would be sufficient to pay 80% of program costs until 2096, and then would decrease to 74% in 2097.

It is important to note that these changes have historically affected younger Americans. When the Full Retirement Age was increased from 66 to 67, this applied to Americans aged 23 or younger at the time. Changing the benefit structure of current and near-term recipients would likely be deemed unrealistic and disruptive to Americans that are approaching retirement. Additionally, this would likely cause a political and administrative nightmare.

Younger Generations (Ages 0-60)

For those further away from receiving Social Security benefits, there likely will be some changes as there were in 1982 to maintain 100% benefits. If history is any indication, increasing payroll taxes and the full retirement age (maybe age 70 instead of 67 for those in their 20s) should hopefully be a minimally disruptive adjustment to fully payout Social Security benefits.

However, what if they don’t make a change? For those in their prime working years, focus on what you can control. Prioritize savings and investments to reduce the risk of being too reliant on Social Security benefits to fund retirement expenses. This can put the ball back in your court when planning for your retirement.

References

Kiplinger. (n.d.). What’s My Social Security Full Retirement Age? Retrieved from Kiplinger: https://www.kiplinger.com/retirement/social-security/603439/whats-my-social-security-full-retirement-age

Rettenmaier, A., & Jansen, D. W. (2023, June 1). Social Security is in trouble: Checks could be cut 23% by 2034. Retrieved from Fortune: https://fortune.com/2023/06/01/social-security-in-trouble-two-economists-strategies-help/

Social Security Administration. (2023, March). Summary: Actuarial Status of the Social Security Trust Funds. Retrieved from Social Security: https://www.ssa.gov/policy/trust-funds-summary.html#:~:text=Beneficiaries%20and%20Benefit%20Payments&text=Total%20benefit%20payments%20for%20the,from%20the%20DI%20Trust%20Fund.

Social Security Administration. (n.d.). Legislative History – 1939 Amendments. Retrieved from Social Security: https://www.ssa.gov/history/1939amends.html#:~:text=The%20Amendments%20added%20two%20new,death%20of%20a%20covered%20worker.

Social Security Administration. (n.d.). Reports & Studies – Trust Fund Reports. Retrieved from Social Security: https://www.ssa.gov/history/reports/trust/tf1941.html#:~:text=The%20Federal%20old%2Dage%20and%20survivors%20insurance%20trust%20fund%20came,Security%20Act%20Amendments%20of%201939.

Tergesen, A. (2023, March 10). Fear Over Social Security’s Future Leads Some to Claim Retirement Benefits Early. Retrieved from The Wall Street Journal: https://www.wsj.com/articles/social-security-benefits-early-future-1fd0fdf2

Wikipedia. (2021). Social Security Trust Fund. Retrieved from Social Security Trust Fund: https://en.wikipedia.org/wiki/Social_Security_Trust_Fund#/media/File:Social_Security_Trust_Fund.png