This is important, so please read.

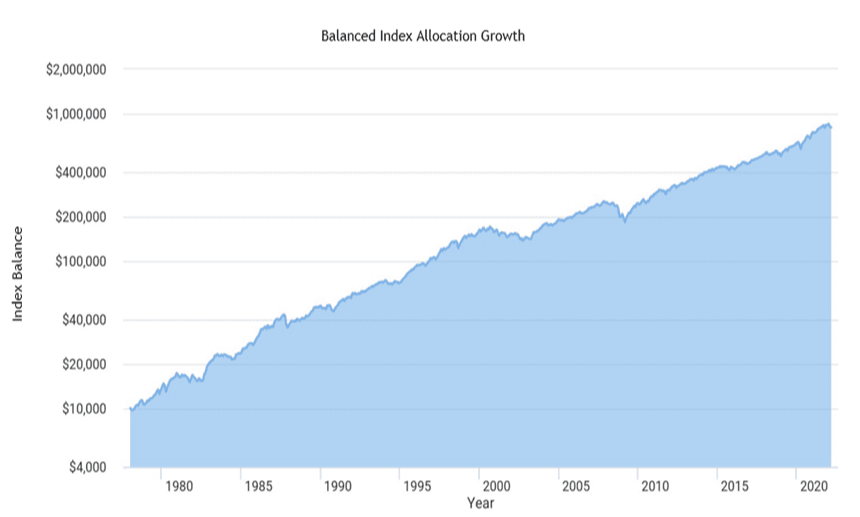

Remember this chart from our recent blog A Timeless Lesson – Don’t Miss the Forest for the Trees?

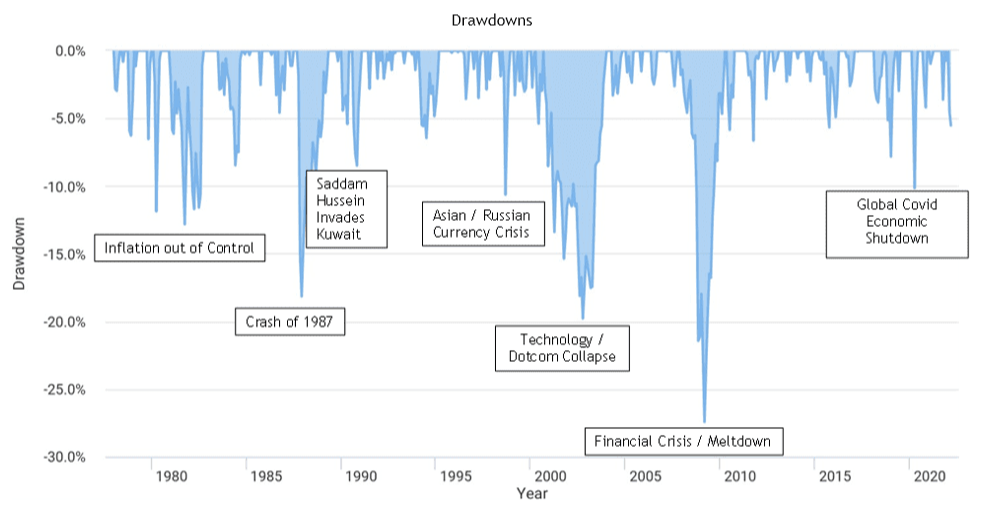

Well, there is another chart below that goes along with it. It is a graphic of the portfolio declines experienced along the way.

Since 1978, there have been 11 occasions where the balanced allocation illustrated above has declined by more than 10% from a high-water mark. They are graphically shown below, along with notes on some of the triggers.

Yes, at times, it can be a little bumpy. Every single decline greater than 10% shown above was accompanied by scary headlines (which of course sparked the decline in the first place). Just like now. And with those headlines, our gut instinct is to protect and defend our portfolios.

But wait – there is a crucial investment paradox that must be understood before acting on our emotions –

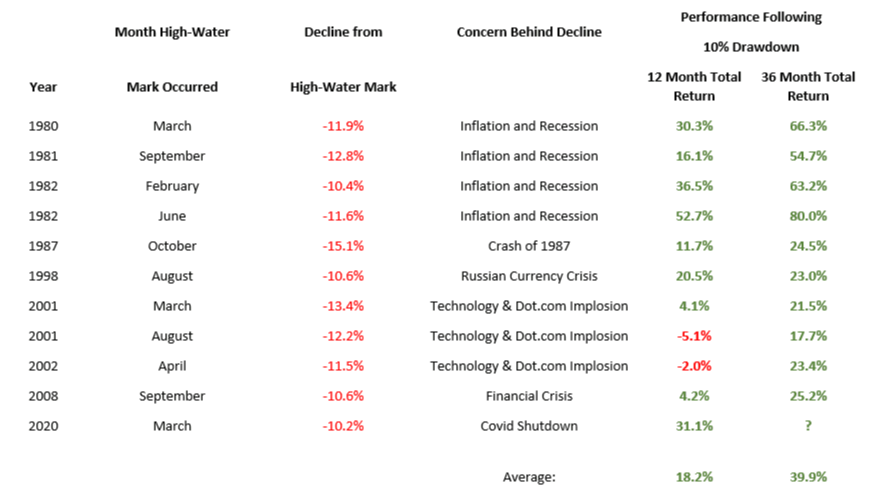

The very best forward returns come not when all is rosy. In fact, they come following times of crisis and duress.

Below is a table highlighting the balanced portfolio declines of 10% or greater since 1978 (no, we haven’t gotten there yet).

Not a bad record. In fact, the world usually doesn’t end.

That being the case, if you have new money, this may be an opportune time to put it to work by leaning into the wind. As Warren Buffet famously says, “Be greedy when others are fearful”. Well, now may be one of those times. Doing what might be emotionally hard here in the short term might well be quite beneficial in the long term. So let’s get to work.

P.S. – If you know of anyone who might benefit from our analysis, planning and investment management, we’d love to hear from you. Our minimums for establishing a new relationship with BCM Advisors (which covers full financial planning and portfolio management) is $500,000.