Many of you may know that I finished school with a degree in engineering. Chemical Engineering to be exact. The type of personality that might be attracted to the engineering sciences most often has a data-driven, problem-solving mindset. Overly touchy-feeling emotional types need not apply.

Now, an engineering personality may be great for building bridges, launching rockets, drilling wells or running a petrochemical refinery, but honestly, the parts of life where a more emotional component is useful often can be a stumbling block to our serenity (is that ironic, or what?).

Which brings me to the financial markets. Let’s talk about emotions. Speaking from experience, it hit me several years ago that –

The financial markets are not a problem to be solved – They are an emotion to be managed.

That concept is so important, let me repeat it –

The financial markets are not a problem to be solved – They are an emotion to be managed.

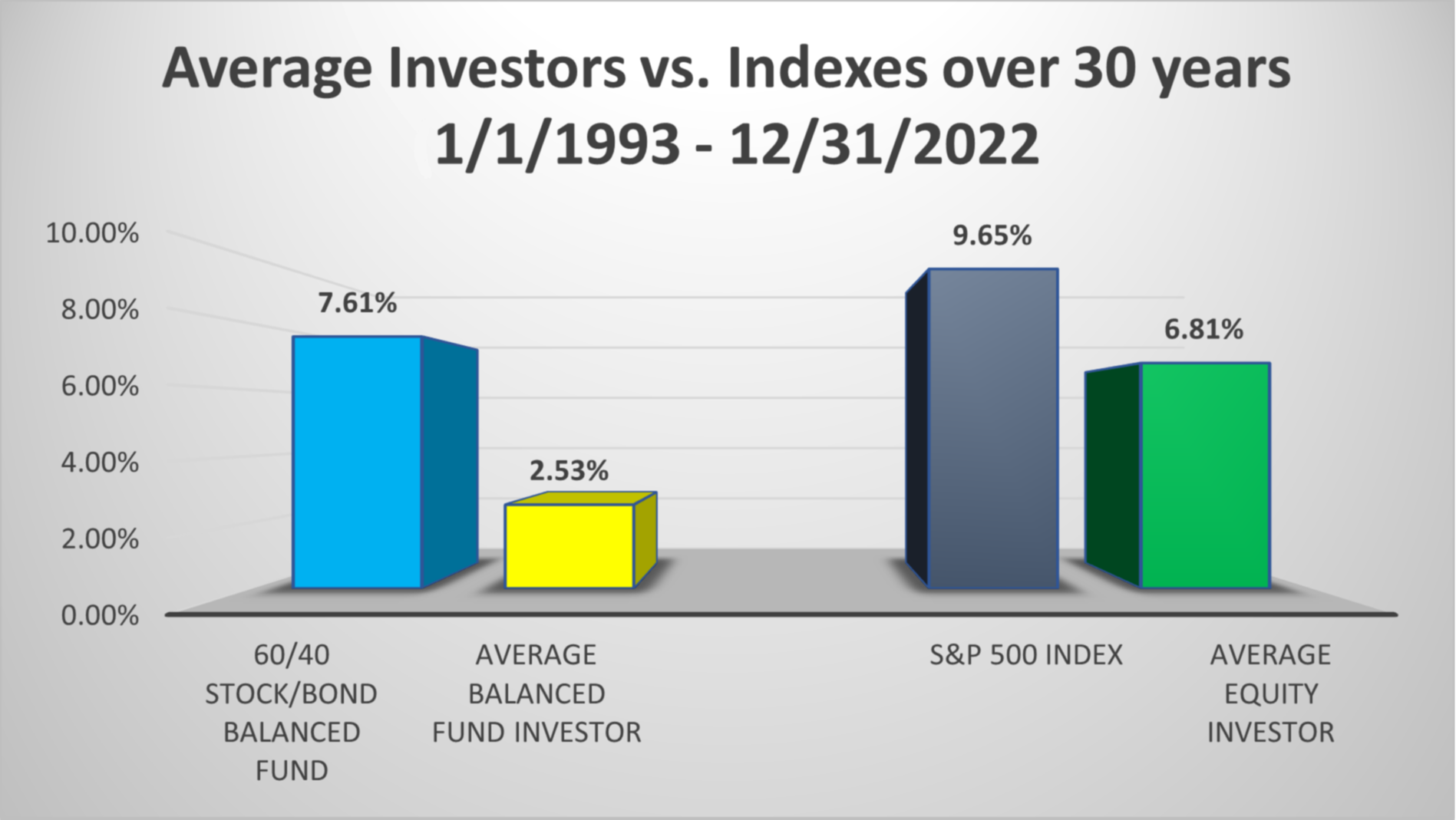

We have written about this before (Stay Focused On What Matters) – approaching the markets with poor emotional control is really, really expensive (average investor in Dalbar study below realized only a 2.53% return (compound that out for thirty years – Spoiler alert: $1,000,000 growing at 2.52% for thirty years increases to $2,116.064. Grow it at 7.61% and the figure is $9,027,738).

As you can see, the average investor’s efforts to outguess markets has resulted in performance during this extended period that falls well-behind both the blue-chip S&P 500 Index as well as a typical balanced portfolio.

I’m here to tell you much of that shortfall can be tied back to bad investment behavior, and there is no more of an egregious offender than those who approach the markets as a problem to be solved rather than an emotion to be managed (yes Bo, I’m talking to the former you).

There are many benefits to working with an advisor who clearly understands this dynamic. However, these benefits may be better appreciated by understanding the concept of “alternate endings”. That is, examining how are things playing out in your investment plan when theoretically measured against how they might otherwise be working if you succumbed to the bad behavior dynamics which plague so many others (as illustrated by the 2.9% average investor result that Dalbar has presented in their study).

Very candidly and frankly, I can assure you that we here at BCM Advisors are fully committed to working with you to develop a long-term investment plan to realize financial success. But, reaching that end-goal is a two-way street. It requires two parties to sign on in order to be successful:

1) We must sign on with our commitment to you, that we will remain evidenced-based investors and will not be swayed by near-term events, fads or chase the next new shiny thing. We have studied the markets exhaustively, and know what works over the long term, and that is what we will implement for you. Period.

2) You have a role as well. We write these investment blogs for your benefit, to keep you focused on the long-term and what is really important. Signal, versus noise. We’re only interested in the data-driven signal, not the emotional noise. That approach has to be fully embraced to get the long-term benefit that you will be entitled to, and deserve, if you climb aboard and allow us to put evidenced-based principles into action.

It’s been said that investing is simple, but not easy. The simple part is studying history, understanding the historical return and volatility parameters of the various asset classes in the financial markets and structuring a portfolio to optimize those characteristics.

The hard part is the emotional part. It is not negotiable – it is imperative – that you allow what is believed to be true regarding the financial markets to be given room to bloom into full fruition for your portfolio.

Ignore the noise and short-term distractions no matter what they may be (Ignore Everything). Let the markets work for you and you’ll likely be the better for it. To that end, one of our primary jobs here at BCM Advisors is seeing to it that we all stay on track.

If you have any questions or would like to discuss it further, please let us know. This is really important.

Disclosure: The graph included in this blog depicts an average equity investor and 60-40 stock-bond balanced fund Investor as determined by Dalbar, Inc. Past performances depicted in the graph, as with any past performance, do not guarantee future results. The S&P 500 Index is an unmanaged market capitalization index that is generally representative of the U.S. stock market. Other indexes may be more appropriate to benchmark your investments against. It is not possible to directly invest in an index. Data in the graph is provided for illustrative and educational purposes only, it does not represent actual performance of any portfolio or account, including those of BCM Advisors, and should not be interpreted as an indication of such performance. Study Source: Dalbar QAIB 2023 study. 60/40 Stock/Bond return, author’s calculation.