Through June 28th, the S&P 500 Index has tallied a -20% return over 68 negative trading days this year1. With each additional negative day in the markets, investor confidence continues to erode. As the emotional toll builds, it reaches a terminal velocity where sound investment decisions begin to be questioned and long-term investment plans can be compromised.

Every investor’s risk appetite is different, but ultimately there is a breaking point for handling market volatility. Since many investors might be approaching (or have already reached) this critical juncture, we thought it would be helpful to put the current losses of 2022 into perspective.

The relentless news headlines don’t make it easy. Reviewing account balances to confirm the headlines makes it worse. While this might appear to create clarity through confirmation, it doesn’t. In fact, it can distort how we make decisions. Because what is happening RIGHT NOW is right in our face, we tend to put more weight on the effect of current events and less on the long-term record of the financial markets.

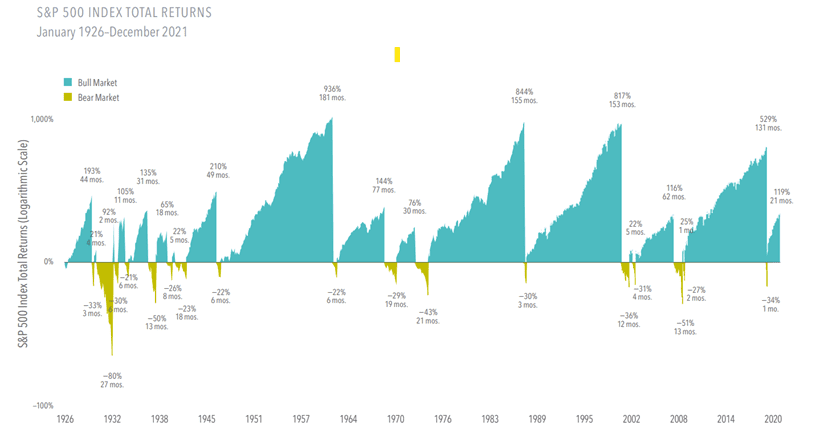

To combat this, it is helpful to understand where the stock market is today compared to its historical performance record. Below is a graph showing the relative gains of both bull markets and bear markets for the S&P 500 Index from January 1926 through December 20212.

If you look at the graph, you can see that the blue peaks dwarf the green troughs. While every green downturn was relatively sharp, they were relatively brief. This was followed each time by a dramatic blue upturn that was relatively prolonged.

It is challenging to keep focused with the flood of stark headlines that occur on a day-to-day basis. However, if we can remember to consider all the information, this paints a completely different picture that swings the weight of our confidence back to understanding why we invest in the first place. If you have any questions, please feel free to give us a call.

1 (Yahoo! Finance, 2022)

2 (Dimensional Fund Advisors, 2022)